How do innovations get to logistics and supply chain firms? Here is the current state of the situation.

We went through a period of high venture capitalist (VC) interest in Supply Chain and Logistics startups. but now with some contraction and with high interest rates, the money is drying up. How will firms get money to develop innovations?

As so often in tech, the big question is, hardware or software? Years ago in Silicon Valley that was the intro line used at parties!

Hardware products require more involvement with the actual situation where they will be made or used– a use test bed. They need to be developed near users’ sites. Software products, like scheduling software or logistics management software, can be built anywhere and tested via the internet. They require much less physical user involvement.

And hardware products require immediate feedback from the users as they are being developed. They need to fit, to match the required form factors, and to be able to handle the situations encountered in the location of use. So customers are consulted as you go along, and serviceability is built in as the design progresses. In fact, often the design is the service that is actually being sold. Serviceability is built into the first viable product.

With software, on the other hand, customer service capability is pushed off down the road. It doesn’t become a burden on the firm creating and offering it till there’s a large customer base. And that’s the moment of truth for software-based firms– when they have a large customer base, and the engineers can no longer handle the problems themselves. Normally this occurs more than five years after the first viable product is produced.

This distinction between hardware and software in serviceability makes a substantial difference to VC investors. They normally want to see their investment returns within 5 years, via a public offering or a SPAC or acquisition. With software, they are more likely to be able to cash out before the difficulty occurs. With hardware, the whole development and service framework must be devised before the innovation firm can cash out.

So VCs strongly prefer software investments.

Hardware investments, on the other hand, are often developed as partnerships with user firms, and they have continued oversight as they go along, along with investments. The concerns are going to include how the product is maintained and what service needs it has. And the investments are more likely to come from logistics or material handling firms that have the ability to provide testing sites and engineering oversight for the project. So the investments are more likely to not come from VCs, but from potential clients or users of the hardware.

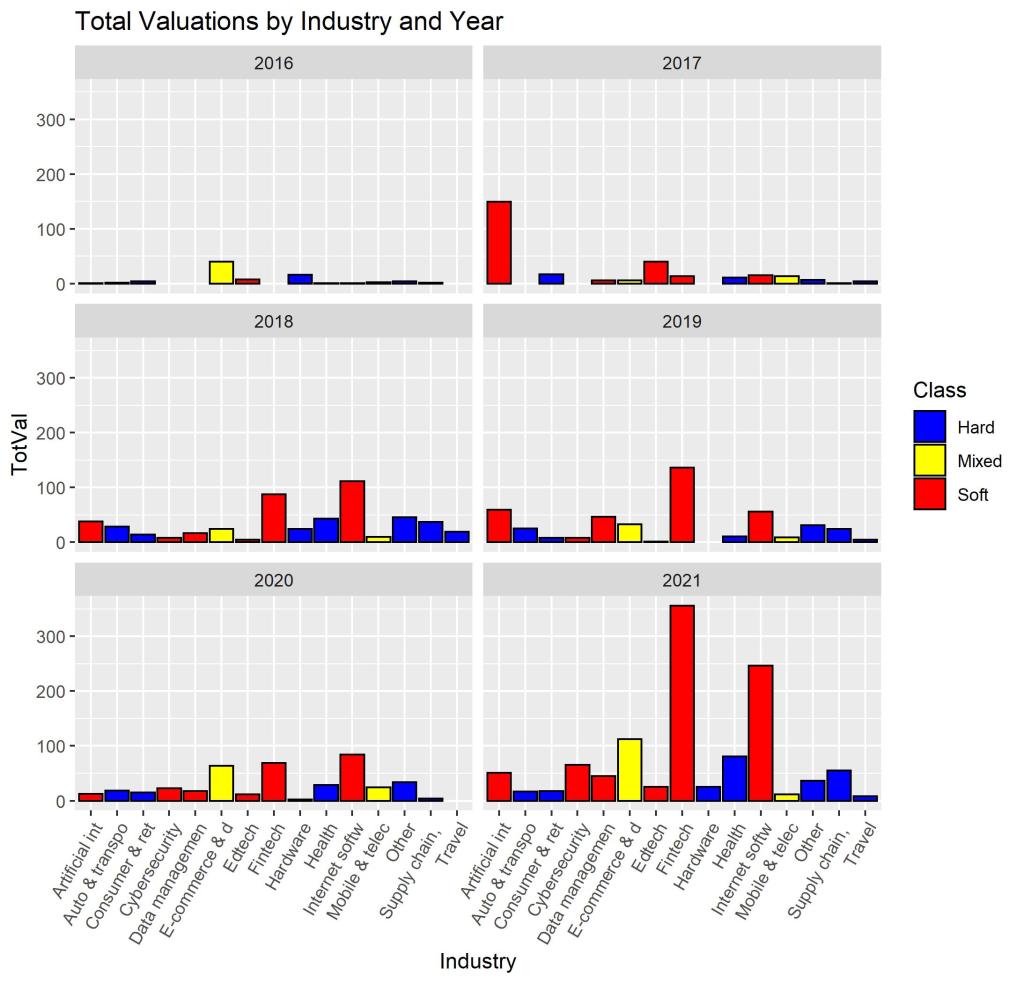

It’s just the way of the world. The graph here shows all the red software investment dominates in most years since 2017. The data is the market valuation of unicorns, firms with over a billion-dollar market valuation, identified by Crunchbase, a firm that tracks startups and innovators and the investors that choose them. Market valuation will give a good idea of the money that can be returned to investors.

Notice also the industries favored (the red bars). Supply Chain investments, and Auto and Transportation, are way down the list. The large valuations are in soft industries like Fintech, Internet software, Cybersecurity, and Artificial Intelligence.

VCs know where they can get the returns. Don’t expect them to jump up and support your new electric forklift or container mover.

Grace Sharkey Friday, June 17, 2022

FreightTech investment: With the cheap money gone, what happens now? – FreightWaves