UMAS is an acronym for University Maritime Advisory Service, a commercial advisory service, or consulting firm, focusing on the maritime segment. It makes use of the University College London shipping team as subject matter experts, and takes on relevant projects for the maritime industry.

Recently they’ve released a report entitled A Strategy for the Transition to Zero-Emission Shipping, which tries to spell out ways that a pathway to a 1.5 degree Centigrade increase could be found. It’s an interesting study because it deals with not only the science-based facts about fuels and propulsion systems, and ship designs, but also with the organizational, regulatory, private investment, and geopolitical aspects of a transformation.

The study outlines three scenarios for a fuel transition away from fossil fuels. These are:

- A spread from a strong first-mover country to others

- Independent spread from several countries

- Global actions (such as the IMO) to drive international spread.

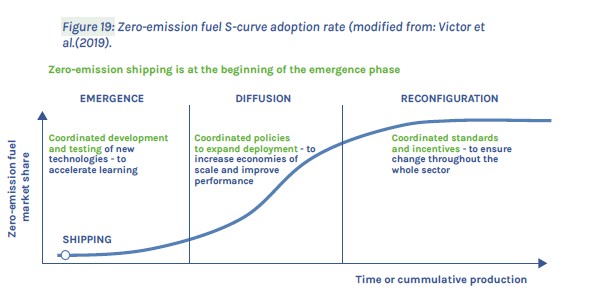

The report goes on to identify levers for change in each scenario, covering three phases of the transition to 1.5 degrees C. The phases are Emergence, Diffusion, and Reconfiguration. They are captured in Figure 19, on page 67 of the report. Here you can see the importance of developing new technologies and investing to expand deployment in the first two phases.

The question they address is how to get all the factors necessary to work for the change in each phase. Especially important are the Energence and Diffusion phases, partly because that’s where we are now, and partly because success there largely determines how we reach the final phase.

The report sees a place for all three scenarios in the effort. It’s quite clear about how companies, governments of states, and international organizations could participate and make the transition easier.

One interesting point is the attention paid to constructing green corridors between different ports, both domestic routes and international ones. The green corridor movement is a powerful driver, and there are now lots of examples starting to appear; they are outlined in the report. The analysis is quite detailed, with actual corridor possibilities outlined, and key national players identified. Experience with the difficulties of establishing them will be important to make the process easier in the future.

The report is also positive about the IMO and its role, while acknowledging some of the difficulties relying on it introduces.

It’s quite an exceptional work, and I recommend reading it. I wish I’d been part of it!

You can read the report pdf here:

Sam Chambers April 5, 2023

UMAS report details green priorities for shipping this decade – Splash247

Sam Chambers April 20, 2023