America’s most prominent inland waterway for commerce is the Mississippi River. It’s been plagued this year by low water. There hasn’t been enough rain in the middle of the continent.

Low water causes barges to run aground, and the remedy is to put less in them, reducing the capacity of the routes. That has been the state of affairs on the river this year as we get into grain harvesting times. The majority of grain exports from the US are from the Gulf Coast, using the Mississippi as the feeder.

It’s a financial blow for farmers and their co-ops if grain deliveries slow. Grain is one of the most important of the US export products, and helps to reduce our balance of payments.

You would think that freight rates would go sky high. But they appear to have steadied right now, in harvest season.

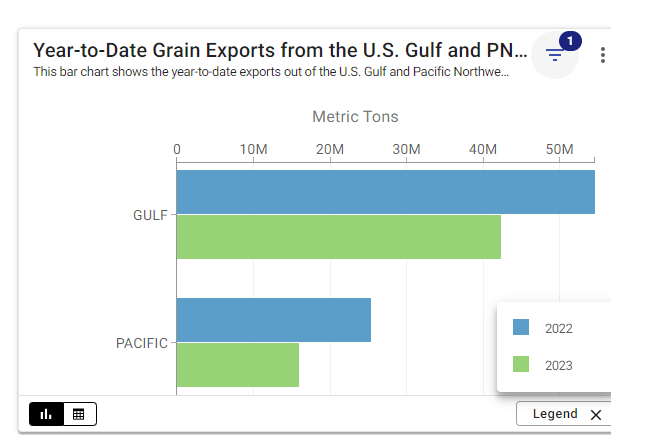

The United States Department of Agriculture (USDA) publishes a Grain Exports Dashboard showing numerous statistics. Grain exports from the US are down from both Gulf Coast and Pacific ports this year.

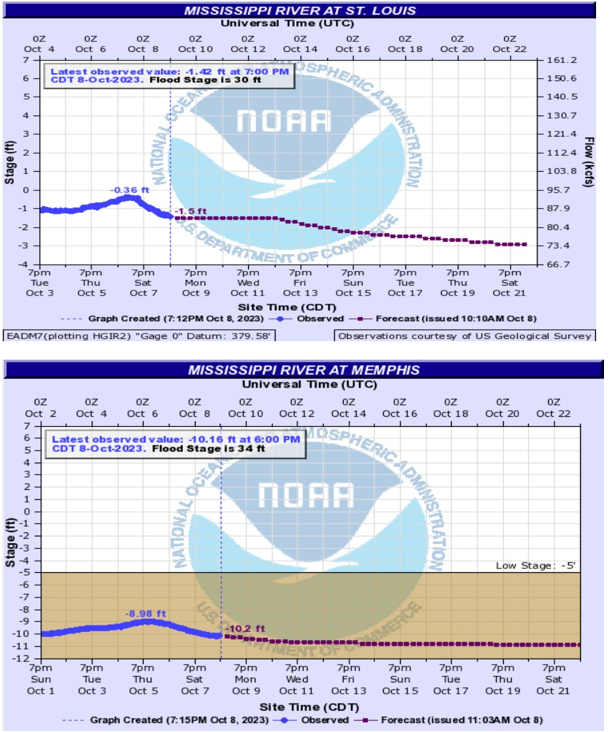

An interesting aspect of the article below is the water level graphs from the United States Geological Survey (USGS). These show a deficit of more than 10 feet at Memphis, and around 3 ft currently at St Louis. Accordingly, drafts of barges have to be reduced, as much as 32% at St. Louis.

Maintaining conditions for commerce on the Mississippi is the responsibility of the US Army Corps of Engineeers.

Grain exports from the Mississippi have been an interest of mine since 2012, when Chris Clott and I and other authors wrote about soybean exports.

John Kingston Monday, October 09, 2023

Water isn’t rising on Mississippi, but barge rates have steadied for now