University College London has published a new study considering in detail how shipowners can comply with the IMO rules for carbon emission compliance. It’s very detailed and takes into account not only the different technologies available, such as methanol and LNG, but also the timing of implementing the various regulations. One has to consider all these factors over the 25 or so years of the lifetime of a ship.

Granted, new technologies and availability of different fuel choices can change from what we can see now, but this impartial study favors ammonia-powered ships over the longer time frame. They suggest dual-fuel ammonia ships might be the best bet for investors in new shipping.

“Although there are significant complexities and uncertainties in what was agreed [at IMO MEPC 83] in April, even conservative projections of how remaining policy details will be finalised results in a ‘no brainer’ choice for shipowners in dual fuel ammonia,” said Dr. Tristan Smith, Professor of Energy and Transport at the UCL Energy Institute.

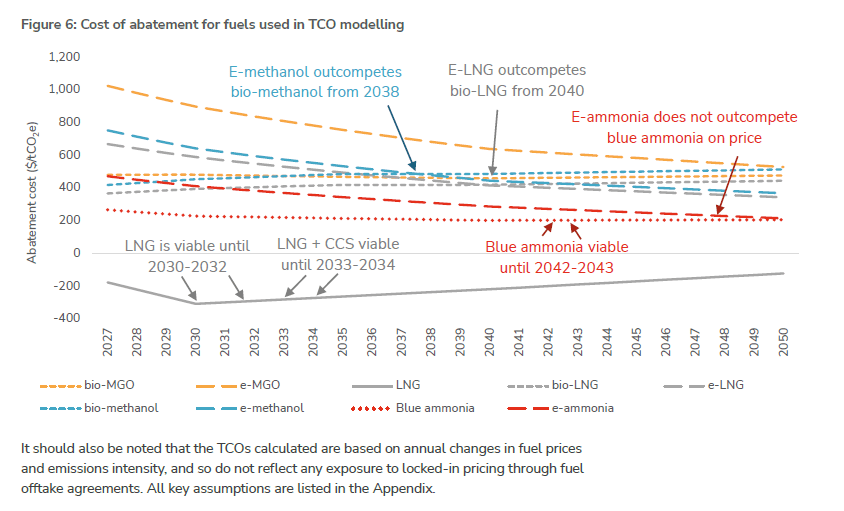

This figure from the report indicates when different fuel choices become cheapest in terms of abatement cost. It seems that e-ammonia never outcompetes blue ammonia before 2050. And LNG remains viable for quite a while, especially with integrated carbon capture.

There are a lot of assumptions in any such study, and the IMO could change the rules in the meantime. But shipowners should be thinking hard about ammonia, and so should international bunker fuel providers.

Published May 29, 2025 9:08 PM by The Maritime Executive

Update 6/5/2025: Fortescue is jumping on the dual-fuel ammonia bandwagon, and has some not-so-polite comments about others in shipping sticking with LNG.

Sam Chambers June 5, 2025

https://splash247.com/fortescues-mission-to-champion-ammonia-goes-global/