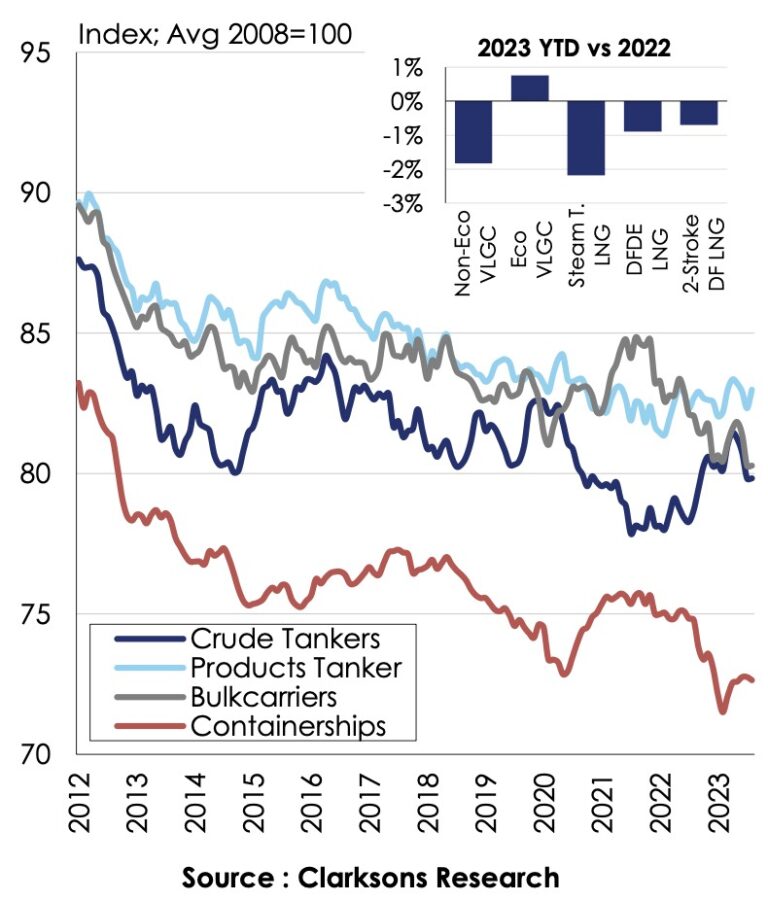

Slow steaming is a good way to save on fuel costs and meet the new IMO requirements. So ships have slowed down. But I was amazed at the graph below, showing a trend for quite a while.

Slowing down is an important way of cutting CO2 emissions from fuel oil. It also implies that more ships are needed to meet planned sailings on a scheduled route. It’s a deliberate reduction of individual ship ‘productivity’, since fewer paid cargo-carrying trips can be made in a year. But it may be a better fit with the demand for shipments right now, and it might result in fuller vessels.

We should remember that slow steaming will not eliminate CO2 emissions problems; it’s a stopgap at best. New types of power with very low or zero emissions through their life cycle well-to-wake must be developed. The investments have to be made.

Sam Chambers October 2, 2023

Bulk carriers and containerships moving at slowest speeds on record this year