The UN Trade and Development’s (UNCTAD) final Global Trade Update of 2025 is a very interesting report. Far from the death of international marine trade, the volume (by value) is surging 7% in 2025. That’s largely due to the increased trade between Asia and the developing world, largely in the South and Africa. US trade is distinctly off, but that’s not stopping the rest of the world from profiting by international trade.

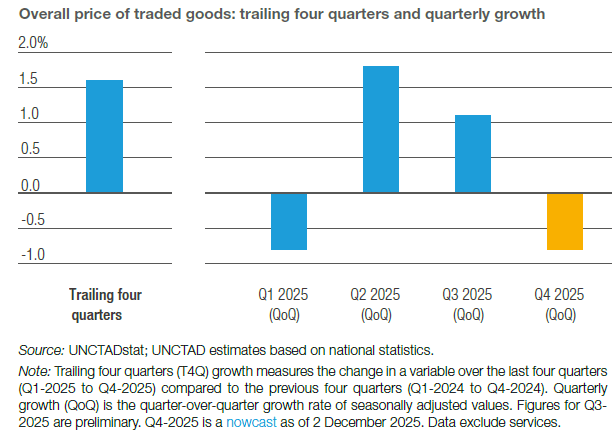

Trade inflation increased in Q2 and Q3 2025, but is set to decrease in

Q4 2025. The graph shows overall price of traded goods: trailing four quarters and quarterly growth. The data do not include services.

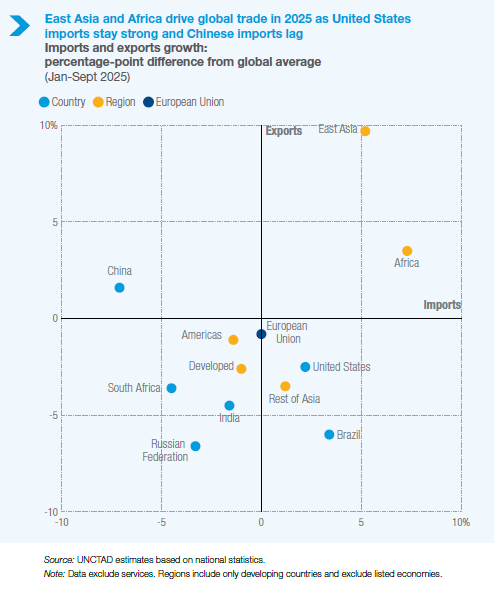

This chart shows that trade indeed has the power to drive costs down for consumers. Tariffs may have a short-term effect, but international trade finds a way to get around the restrictions. No market in the world is so big that you have to trade there. And ultimately the futility of tariffs hits home, and countries back off from imposing them. A quadrant diagram of exports and imports shows how East Asia and Africa are driving global trade now. They are the two regions showing positive percentage growth in both exports and imports through September 2025. (Again services are excluded).

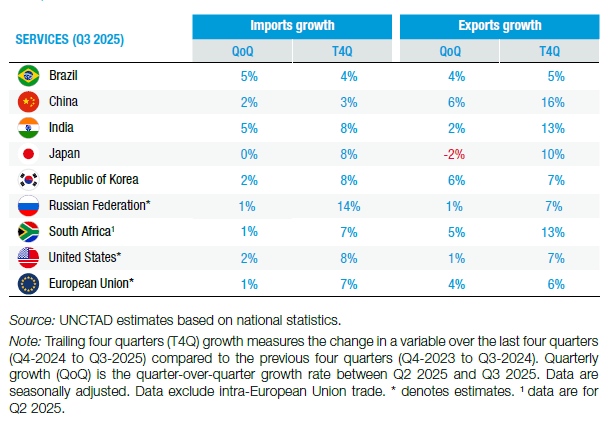

Services trade growth continued to be strong. This chart shows China, India, Japan, and South Africa led export growth by percentage, while many developed countries continued to increase major imports of services.

The whole report makes interesting reading. Kudos to the authors. It can be found here:

Total Views: 742 December 9, 2025