Why did Maersk and IBM cancel the TradeLens program?

Recall, when it was introduced 4 years ago many folks saw it as a step in the right direction for logistics, especially global ocean shipping. A single source of information in the cloud where you could go to verify all kinds of shipping information about your cargo. That’s if it worked.

And all of this built on the newly famous blockchain design, which burns tremendous amounts of energy and creates multiple copies of the data just so big brother cannot be controlling everything.

But who is controlling TradeLens? None other than IBM, the devil brought to life in the legendary 1968 science fiction movie 2001, in which a computer named HAL, who could converse with you, set out to destroy the astronauts on their voyage to Mars and take over the spaceship from them. HAL was just one step away from IBM.

Recall that the raison d’etre for blockchain was to eliminate any central control point, so that your money and transactions were free of any control or attempt to change them. That was fiction anyway; it turns out that in every implementation there is a set of controllers. For Bitcoin, it’s the miners, who have the computing power to make changes even in the code; three or four big miners handle most of the blocks of transactions, and that is who’s consulted when code changes are in the offing; they have the votes. Ethereum has a different structure, and is now moving to a new method of determining whether a block is valid, called Proof of Stake. It’s supposedly a lot faster and less energy-intensive; we will see; but it’s an oligarchy all the same, with miners needing to put up a stake they forfeit if they make a mistake and post an invalid transaction. Again the ones who put up the largest stakes are the ones consulted when a code change is desired.

The IBM/Maersk platform for TradeLens didn’t hide who was controlling it; it was those two. From the start there was a lot of suspicion that Maersk was trying to use it to lock in business from shippers who would normally use a freight broker or 3PL. Was Maersk really trying to lure smaller shippers by providing a platform for them to look at the progress of their shipments safely from end to end?

The reason given by Maersk and IBM for halting TradeLens is that there isn’t enough business after four years to continue supporting it. In the four years, according to the site (second article below) there have been 70 million containers and 35 million documents processed. That’s a lot of traffic. Over 20 port terminals are also participants, including in Singapore, Hong Kong, and Rotterdam.

Another major question is who owns the transactions processed through TradeLens? Should the firms need to pay to get their transactions suppressed from view? If IBM and Maersk own them, that could be seen as anticompetitive.

Perhaps the real reason is that Maersk and the other participating liner companies, Hapag-Lloyd, ONE, CMA CGM, and MSC, all majors, are growing afraid that they will lose their blanket exemption from antitrust to operate the container shipping alliances. Both the US and the EU are looking hard at whether the alliances should have their powers revoked, due to anticompetitive activity. If new regulations come about, the alliances will go down, and the liner companies will no longer be able to share their ships on the alliance routes.

Instead if they want to offer weekly service they will need to each provide enough ships. This would represent a tremendous amount of extra capital requirement. Rich as they have become from the recent high prices during COVID, none of them can afford that much capital.

I think any regulations that come about will tinker with the alliance structure but won’t do away with sharing capacity. Regular service is what shippers want. The target is excessive blanked sailings by these companies.

Blanked sailings are like ‘bait-and-switch’ selling. You offer a sailing on the 15th, and people sign up their cargo. But then closer to the 15th, you realize there isn’t a full load, and you can’t pay for the voyage. So you blank, or cancel the sailing, and move all the cargo shipments to later voyages. The customer is not getting the time frame for delivery of the cargo that he wanted, though technically he is still getting his trip. But the time element in modern business is what is important.

Many shippers are saying that signing up a cargo for a voyage is like Russian Roulette. You don’t know if you’ll get it.

I’m not sure what a regulation would look like that would reduce the frequency of blanked sailings but still allow the carriers to share capacity on the routes. Perhaps specified service levels on the routes would be enough; designating a route for sharing in an alliance would require also specifying guaranteed sailings at least every n days, a specification of a service level for the route.

Suppose the route cycle time is N days, the average time required to complete an entire trip around the closed circuit, including delays at stops, and return to the origin port ready to load. Clearly if N=n, only one ship is needed, but n could be pretty large, say 30 or 40 days, not soon enough for big shippers. For a service level of n = N/2, two ships would be needed, and so on. The number of ships is given by algebra as N/n. Since fractional ships are not allowed, the proper expression is CEILING(N/n) ships required, to steal from an Excel function; effectively rounding up to the next larger integer.

So a commitment to a given guaranteed service level, no blanking allowed, could force the carriers to be more aggressive in filling up the ships. Knowing they had to sail every so often they would work harder to fill the ships.

So consider a route from Tianjin to Rotterdam, including Shanghai, with stops in between. The latest Hapag-Lloyd route sheet shows that this trip called FE2 takes from 16 Nov to 7 Jan, a time of 52 days, on the ONE Triumph ship. The route sheet is difficult to interpret, so I’ve extracted the stops and timings in a table.

| Port | Date |

| Tianjin | 16 November |

| Singapore | 20 November |

| Shanghai | 25 November |

| Ningbo | 28 November |

| Nansha | 1 December |

| Yantian | 3 December |

| Singapore | 7 December |

| Southampton | 30 December |

| Le Havre | 1 January |

| Hamburg | 3 January |

| Rotterdam | 7 January |

That does not allow for the return trip. But we can assume they have another ship ready when they want to go again.

To gurantee service every other week (14 days) on this route they need CEILING(52/14) or 4 ships available. That leaves an excess capacity of about 28% (four days out of 14) for issues that may occur.

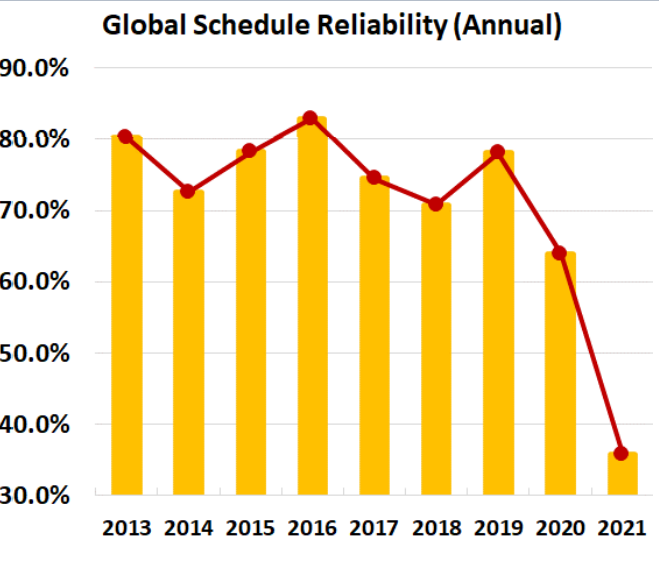

Now factor in schedule reliability. According to their Global Performance Webpage, Hapag-Lloyd’s schedule reliability is 39% on 12/4/2022. This places them 8th among container shipping companies in the Sea Intelligence GLP rankings. We’ll give them 40% to make the calculations easier

If they are only on time 40% of the time, that means that on 2 of every 5 runs on this route there is no ship available to replenish the stock of ships to serve this route. This measure does not show us how late they are– it might be just a day, or it could be several or many days. Weather at sea and delays loading and unloading at ports are some of the major factors in being late. These are mostly outside control of the line, though in some cases, such as errors in advance notice of arrival, could trigger the delays. So this measure is not really sufficient to help us figure how many ships they need to service the route biweekly. We need the distribution of lateness times to be totally accurate.

So we’ll guess. We’ll assume half of these are over 4 days. Remember that 4 days out of 14 is the excess capacity on the route. So half of the time the delay is too long to be absorbed by the excess capacity. So based on these figures they would need to blank a sailing 1 out of every 5 times, for lack of capacity.

Based on this distribution of lateness, a big fat assumption, a possible rule of thumb might then be to punish blankings in excess of 1 out of every 5 scheduled trips. Thus if there were two blankings in any five-trip period, the carrier would be penalized for excess blankings.

It’s not known how the reliability measure would perform if such a rule were instituted, except that it would probably improve. In general, carriers need to improve their schedule reliability a lot to become more consistent with customer goals for reliability of receiving shipments. They can’t plan inventory well if there is so much lead time uncertainty.

Some enterprising scholar of maritime affairs could conjure up a simulation that would act as a ‘digital twin’ of this route. That’s the new term of art. With the simulation we could observe how the schedule reliability and the blankings and performance on the route in terms of number of ships required would work. We could throw at the model odd states of affairs, like China closing ports for extended periods, or major storms taking out ports or affecting the route for several days, or congestion like earlier this year at the US ports in Los Angeles and Long Beach, where waiting lines grew to over 100 ships.

- Would the penalties need to be more frequent?

- Would they need to be larger?

- Would the blankings go up or down?

- How would the schedule reliability be affected?

One thing we could not model, though, would be the amount of screaming from the liner carriers. And we also can’t model the politics, or the legality in the different jurisdictions, of such a scheme as a way of increasing competition. the penalties might actually reduce competition; alliances might have a harder time forming, preventing sharing of ships and raising the cost of running regular service. Those in favor of reshoring commerce would think that’s good. But most of the world has benefited greatly by global trade, and it has raised the economies of many countries, though labor dislocations have been created, making special noise in some developed countries.

I leave it to the international trade experts to design rules that would improve customer service for international container cargo and smooth out the lead time variations which cause inventory shocks, while maintaining the flow of international goods.

These below are thoughtfuil articles and make us think hard about competition in international trade.

By Charlie Bartlett, Technology Editor 02/12/2022

Did Maersk clash with tough EU competition rules with TradeLens? – The Loadstar

Fate of TradeLens data in the ether as Maersk ditches blockchain platform – The Loadstar