The International Chamber of Shipping (ICS) has released its latest Shipping Industry Flag State Performance Table for 2025/2026. This report is updated annually. Flag state performance is growing in importance for the shipping industry.

Rounds of sanctions are occurring often, including sanctions of registries. Some ships are changing registries or even using false registries. Shippers, brokers, and carriers need to know the status of the ships they will be using.

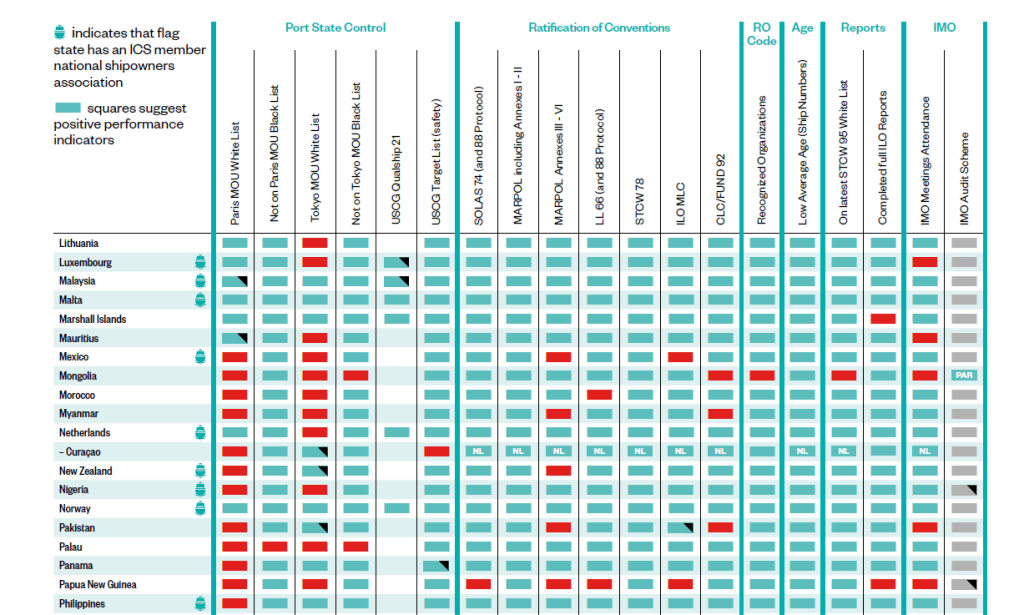

The report highlights the criteria used to rate the flag states. Green squares signify positive performance by a flag state. Red squares highlight potentially negative performance. Various shades of grey and some additional markings indicate what the report calls neutral indicators.

Port Shipping Control (PSC) authorities provide most of the data for the ratings. There are three principal agencies and one target list:

- Paris Memorandum of Understanding (MOU) countries

- Tokyo MOU countries;

- United States Coast Guard (USCG) Qualship 21 program

- Respective blacklists or target lists of the agencies.

To be identified via the Paris and Tokyo MOU white lists, a flag must have undergone at least one inspection in the previous three years. For the Qualship 21 program, a flag must have made at least three distinct arrivals in each of the previous three years. For the Target Lists, flags listed as ‘Medium Risk’ have a neutral indicator.

Ratification of international maritime conventions such as UNCLOS, IMO and ILO also factor in. Some states may have partially ratified or accepted these conventions, or may have legal conflicts preventing ratification. These are also considered in the ratings.

A short section of the table is displayed here:

Source: ICS Shipping Industry Flag State Performance Table 2025/2026

The PDF report is accessible here.

It’s very important to have an independent verification of the performance of flag states regarding the major maritime conventions. These ratings give interested parties information to help them follow up on the standards the ships they hire are meeting. Questions should be raised before booking passage.

Sam Chambers January 28, 2026