Asim Anand writes in Platts agriculture report that China is suffering from substantial losses in their pig population due to African swine fever (ASF). The pig herd has declined by 20%, and that translates to less need for soybeans. Estimates run to 22 million mt less.

I’ve been watching the world soybean flows since 2014 when my colleague Cris Clott and I, working with Althea and Libby Ogard, and with help from Scott Sigman, wrote an article about the soybean flows and the possibilities for containerization of soybeans as opposed to bulk transport.

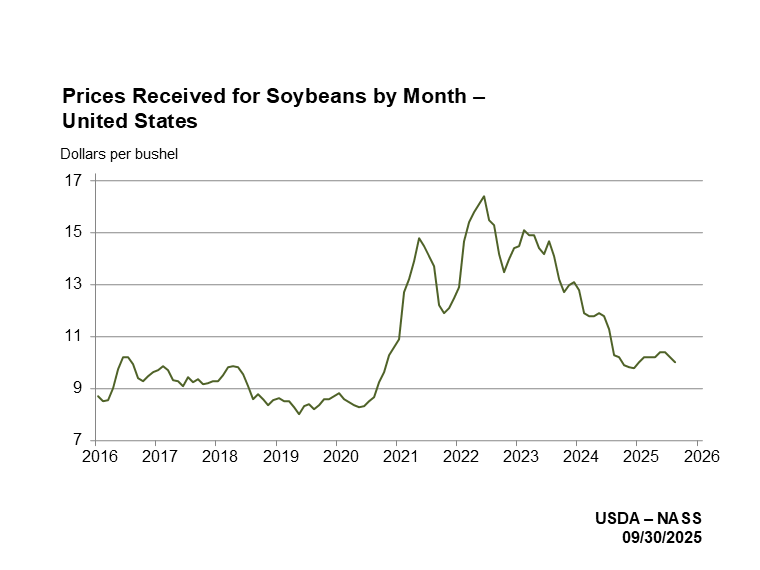

US soybean exports to China have fallen by 85% due to the imposition of a tariff of 25% on US products by China. So world wide there is a glut of soybeans and prices are dropping fast. Prices of US soybeans are under $9 per bushel, the lowest since 2016. (See graph from USDA-NASS).

Graph from https://www.nass.usda.gov/Charts_and_Maps/Agricultural_Prices/pricesb.php retrieved 2019-05-14.

We can expect this trend to continue, and as the trade war with China escalates, US soybeans will cease to be exported to China at all. Exports represent about half of the US production each year, and China is the largest customer. We can hope for a change, but I’m guessing this market is virtually gone for the US, as the other soybean-producing countries, Brazil and Argentina especially, move in and establish supply chains around the world.

Table from https://beef2live.com/story-top-10-export-destinations-soybeans-0-122616, retrieved 2019-05014.

via Swine fever set to reduce China’s soybean imports further: USDA | S&P Global Platts

via Swine fever set to reduce China’s soybean imports further: USDA | S&P Global Platts

via

via